Sterling Steadies, Euro Stages Surprise Rally as Dollar Retreats

London: 26 March 2024 (TraderMade): The US Dollar faced a correction this week, offering some relief to the Pound Sterling and Euro. Both currencies capitalized on profit-taking after the Greenback's recent surge.

Key Takeaways

- GBP and EUR rose against the USD on profit-taking after the Dollar's recent strength.

- BoE's dovish hints boosted the Pound, while a potential shift in ECB policy stance supported the Euro.

- US economic data and the Fed's policy decisions remain key factors to watch for further currency movements.

Pound Rebounds on Dovish BoE Hints

The Pound Sterling (GBP) gained ground against the US Dollar (USD) after the Bank of England (BoE) signaled a potentially dovish shift in its monetary policy stance.

Two BoE policymakers who previously advocated for rate hikes softened their stance, and Governor Bailey acknowledged market expectations for rate cuts this year as "not unreasonable."

Investors are now looking ahead to February US core PCE inflation data, a key indicator that could influence the Fed's policy decisions.

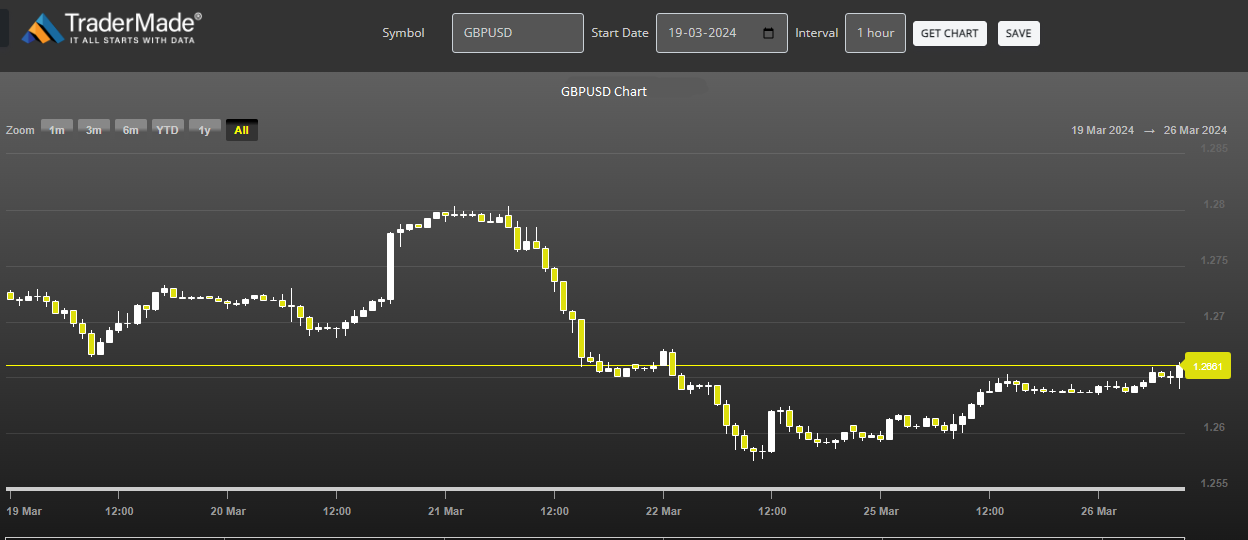

Pound Sterling Treads Water Against US Dollar Last Week

The Pound Sterling (GBP) exhibited a narrow trading range against the US Dollar (USD) over the past week (19 March 2024 - 26 March 2024). Despite some intraweek volatility, the GBPUSD pair ended the period nearly flat, closing at 1.26544 on 26 March, compared to 1.27224 on 19 March.

The week started positively for the Pound, with GBPUSD climbing to a high of 1.27873 on 20 March. This upward trend could be attributed to factors mentioned in your previous references, such as a dovish shift in the Bank of England's monetary policy stance. However, the gains were short-lived, with the pair retreating later in the week.

The GBPUSD fluctuated within a tight range for the rest of the week. On 22 March, the pair dipped to a low of 1.25753 before recovering slightly. Market sentiment and potential profit-taking after the initial rise might have influenced this movement.

Overall, the lack of a clear directional bias and potentially counterbalancing factors kept the GBPUSD pair relatively stable throughout the week. Looking ahead, key economic data releases and central bank pronouncements, particularly from the US, could provide further direction for the Pound in the coming days.

Euro Rebounds Despite Hawkish Fed

- The Euro (EUR) staged a surprise rally against the USD despite hawkish comments from Federal Reserve officials.

- The ECB, on the other hand, struck a more dovish tone, hinting at the possibility of earlier-than-expected rate cuts.

- This divergence in central bank stances could be a temporary factor behind the Euro's rebound. US durable goods data for February could offer further clues on the Dollar's direction.

Euro Stages Surprise Rally Against US Dollar Last Week

The Euro (EUR) defied expectations and staged a modest rally against the US Dollar (USD) over the past week (19 March 2024 - 26 March 2024). Despite starting the week near 1.086, the EURUSD pair ended the period slightly higher at 1.08522.

This uptick comes against the backdrop of hawkish comments from Federal Reserve officials who signaled a potential delay in interest rate cuts. In theory, a hawkish Fed would strengthen the Dollar relative to other currencies. However, the Euro managed to claw back some ground.

The data suggests a volatile week for the Euro. It initially gained some traction, reaching a high of 1.094 on 21 March. This upward trend could be attributed to dovish hints from the European Central Bank (ECB) suggesting the possibility of earlier rate cuts, making the Euro more attractive.

However, the Euro gave up some of these gains later in the week, dipping to a low of 1.080 on 22 March. This slide could reflect profit-taking after the initial rise or a response to broader market sentiment.

Despite the volatility, the Euro managed to end the week slightly higher than where it began. This rate movement suggests a potential shift in market sentiment or a possible counterbalancing effect from the ECB's dovish stance mitigating the usual impact of a hawkish Fed.

Looking ahead, upcoming economic data releases and central bank pronouncements will be crucial in determining the Euro's future trajectory against the US Dollar.

Sterling and Euro find temporary respite, but the Dollar's direction hinges on upcoming US data and the Fed's stance.