Morning Digest: Yen, CHF, Asian Stocks See Green, Europe Stalls, Oil Falls

London: 15 February 2024 (TraderMade): Dive into our Morning Digest to navigate the mixed signals across currencies, stocks, and commodities, and stay ahead of the curve as economic data and earnings reports paint a clearer picture later today. While some corners of the world bask in positive sentiment, others remain cautiously shaded.

Key Takeaways

- Increased risk aversion boosts safe-haven currencies like JPY and CHF.

- Asian markets experience modest gains, while European markets wait for direction.

- US market futures point towards a flat open.

- Oil prices face selling pressure and decline.

Forex Market Sees Safe-Haven Strength

The Japanese Yen (JPY) and Swiss Franc (CHF) are the top performers against the US Dollar today, rising 0.3% and 0.09%, respectively. This suggests increased risk aversion - potentially due to geopolitical tensions or economic uncertainties.

Conversely, the Norwegian Krone (NOK) and Australian Dollar (AUD) experience slight declines, losing 0.03% each against the Dollar.

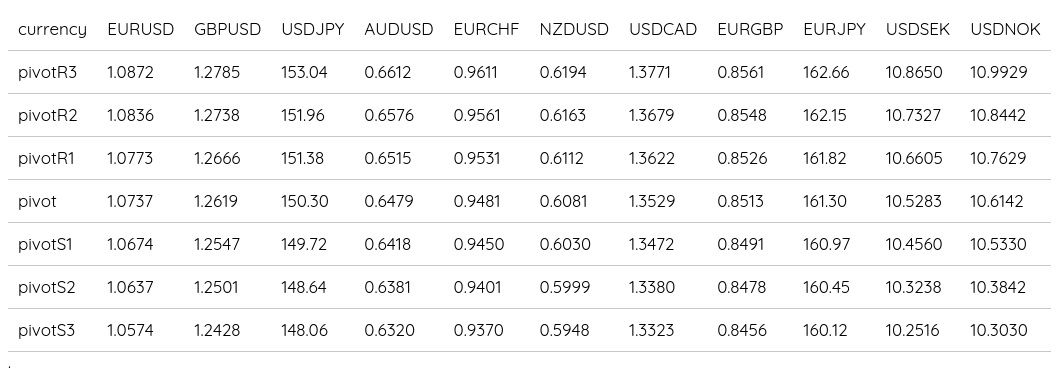

FX Daily Pivot Points

Asian Stocks Open Positive, Europe Waits

Asian markets started the day on a slightly optimistic note. The Nikkei 225 in Japan gained 0.04%, reaching 38,141.5 points, while the Hang Seng Index in Hong Kong rose 0.06% to 15,918.0 points.

European markets, however, lack clear direction at this time.

- The FTSE 100 in the UK (UK100 - currently 7597),

- CAC 40 in France (FRA40 - currently 7695.5), and

- DAX 30 in Germany (GER30 - currently 17001.68) are all trading flat.

This could be due to investors awaiting further cues from upcoming data releases or earnings reports.

US Market Futures Hint at Flat Open

S&P 500 Futures are currently up a mere 0.02%, suggesting a subdued start for the US stock market when it opens later today.

- The Standard & Poor’s 500 index (SPX500) was 5002.15.

- Nasdaq 100 (NAS100) was 17811.102.

- Dow Jones Industrial Average (USA30) was 38425.

Oil Prices Retreat Under Selling Pressure

Both WTI Crude Oil and Brent Crude Oil futures are trading lower today. WTI futures are down 0.24% at $76.09 per barrel, while Brent futures have decreased by 0.25% to $80.90 per barrel. This decline could be attributed to renewed selling pressure or concerns about global economic growth.

- Brent Crude (UKOIL) declined 0.31% to $80.851 a barrel.

- WTI Crude (OIL) followed suit - dipped 0.34% to $76.02299 a barrel.

- However, Natural Gas (NATGAS) surged 0.6% to $1.6725/MMBtu.

Summary

The global market presents a mixed picture this morning. While safe-haven currencies gain and Asian stocks show cautious optimism, European markets remain undecided, and oil prices decline. Upcoming economic data and company earnings reports might provide further clarity and drive investor sentiment in the coming hours.