Morning Digest: Vigilant Start with USD & CHF Gains

London: 8 May 2024 (TraderMade): Welcome to today’s Morning Digest! The global financial markets present a mixed bag today, with USD & CHF shining in Forex and gold and Silver shining in Precious Metals, yet global indices are mixed (mostly flat or declined), and Crude Oil dipped. Here are the sector-wise details:

Key Takeaways

- USD and CHF shined today in G10 forex, while NOK (down 0.42%) and JPY (down 0.34%) declined versus the dollar.

- In Asia, the Nikkei (JPN225) plunged 1.11%, and the Hang Seng (HKG33) dipped 0.41%.

- European indices like FTSE (UK100), CAC (FRA40), and DAX (GER30) trade flat.

- US indices like S&P500 (SPX500, Nasdaq (NAS100), and Dow Jones (USA30) trade almost flat.

- In the Energy space, Brent Crude (UKOIL) dipped 0.52%, WTI Crude (OIL) declined 0.57%, and Natural Gas (NATGAS) surged 0.42%.

- Among Precious Metals, Gold surged 0.2%, and Silver surged 0.42%.

G10 Forex

USD and CHF are Top Gainers

In the G10 FX Market, the US Dollar (USD) and Swiss Francs (CHF) are the top gainers today. The USDCHF pair surged 0.09% so far to 0.90921.

NOK and JPY are top laggers

Norwegian Krone (NOK: slipped 0.42%) and Japanese Yen (JPY: down 0.34%) are the top losers versus the dollar, respectively.

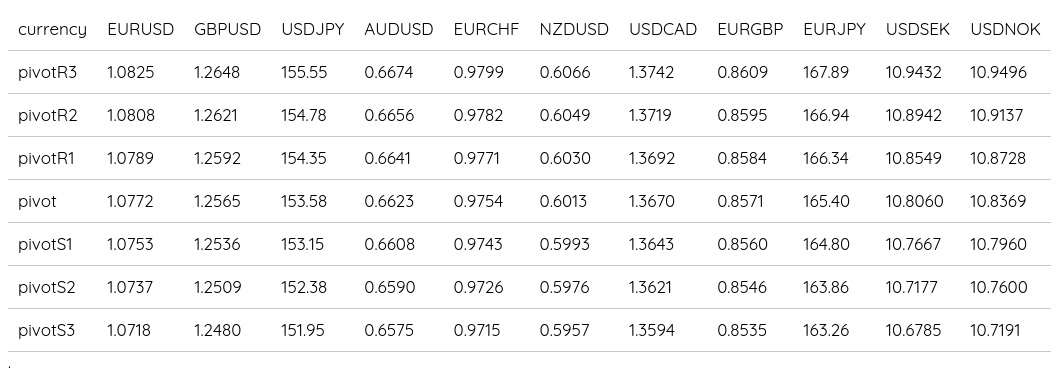

Forex Daily Pivot Points

Global Indices Mixed

Asian Markets Dipped

Asian equities were trading weaker today. The Hang Seng was trading at 18408.0, down 0.41%, and the Nikkei 225 was trading at 38256.5, down 1.11%. Foreign fund outflows may be the reason behind the decline of Asian markets today.

European Indices Flat

- The UK’s FTSE 100 (UK100) trades flat at 8352.8.

- France’s CAC 40 (FRA40) trades flat at 8076.5.

- Germany’s DAX 30 (GER30) trades flat at 18472.

Significant losses in healthcare stocks might have partially offset the surge in mining stocks - causing European indices to remain mostly unchanged.

US Equities Futures Dipped

Looking at Equity Futures so far, The SP500 Futures was trading at 5188.0996, down 0.07%.

Popular US Indices Mixed

- Standard & Poor’s 500 (SPX500) trades flat at 5190.0996.

- Nasdaq (NAS100) trades flat at 18101.3.

- Dow Jones Industrial Average (USA30) slightly edged up to 38905.

Disappointing Disney earnings reports, a consistent fall in treasury yields, and uncertainty about the Fed rate cut might be some reasons behind stagnancy in US markets.

Energy Markets

Crude Oil Futures Slipped

In the energy space, oil futures trade is weak today. The WTI Crude Futures were trading at 77.722, down 0.46%, and the Brent Crude Futures were trading at 82.526, down 0.47%.

Spot Prices Dipped

- Brent Crude (UKOIL) plummeted 0.52% to $82.49 a barrel.

- WTI Crude (OIL) dipped 0.57% to $77.697 a barrel.

- Natural Gas (NATGAS) surged 0.42% to $2.3715/MMBtu.

Surging US crude oil inventories and easing Middle-East tensions might be behind this fall in crude oil prices.

Precious Metals Shine

- Gold (XAUUSD) surged about 0.2% to 2318.755.

- Silver (XAGUSD) surged 0.46% to 27.369.

To Summarize

The global financial markets throw a mixed mosaic at the morning bell today. USD and CHF lead the pack in G10 Forex; global indices are mostly flat or declined, crude oil lost ground, natural gas edged up, and gold and Silver gained ground significantly. Stay with us for the latest updates across global financial markets throughout the day as the trading day unfolds layer by layer.