Morning Digest: NZD, CAD, Asian Equities, and Oil Soar

London: 22 February 2024 (TraderMade): The sun rises on a global market landscape painted with contrasting colors. While Asian investors wake up to optimism, European traders adopt a cautious wait-and-see approach. Let's dive into the key regions and asset classes to understand the story unfolding:

Key Takeaways

- FX: NZD & CAD lead gains vs. USD, JPY & USD dip.

- Asian Equities: Nikkei & Hang Seng surge on optimism.

- European Equities: DAX, CAC & FTSE flat, awaiting cues.

- US Equity Futures: S&P 500 Futures inch up cautiously.

- Energy: Brent & WTI Crude extend rally on tight supply & geopolitical tensions.

G10 FX

Kiwi and Loonie Lead the Charge

Antipodean currencies shine! The New Zealand Dollar (NZD) and Canadian Dollar (CAD) climbed 0.24% and 0.16%, respectively - against the Dollar, reflecting improved risk sentiment and potential commodity-linked strength.

Yen and Dollar Down

Yen (JPY) and Dollar (USD) fall out of favor, dipping slightly, as investors seek opportunities beyond safe-haven assets.

Forex Daily Pivot Points

Global Equities and Indices

Asian Equities: Land of the Rising Optimism

Joy in the East! Nikkei 225 (up 1.59% at 39129) and Hang Seng (up 1.18% at 16626) surged significantly, indicating positive sentiment in Chinese and Japanese markets. This might be fueled by hopes of economic recovery or supportive policies.

European Equities: Waiting for a Cue

The continent takes a breather! Major European indices like The UK’s FTSE (UK100 - Currently at 7684.75), France’s CAC 40 (FRA40 - Currently at 7839.25), and Germany’s DAX (GER30 - Currently at 17164.602) remain almost unchanged, suggesting investors are waiting for further developments or key data releases before committing to specific directions.

US Equity Futures: Cautious Optimism

S&P 500 Futures gain a slight 0.25%, hinting at a potentially positive start for Wall Street later today, but the cautiousness from European markets might temper the sentiment.

Popular US Indices

- The Standard & Poor’s 500 (SPX500) slightly edged by 0.3% to 5022.25.

- Nasdaq (NAS100) gained 0.49% to 17744.102.

- Dow Jones Industrial Average (USA30) followed suit and surged 0.29% to 38685.

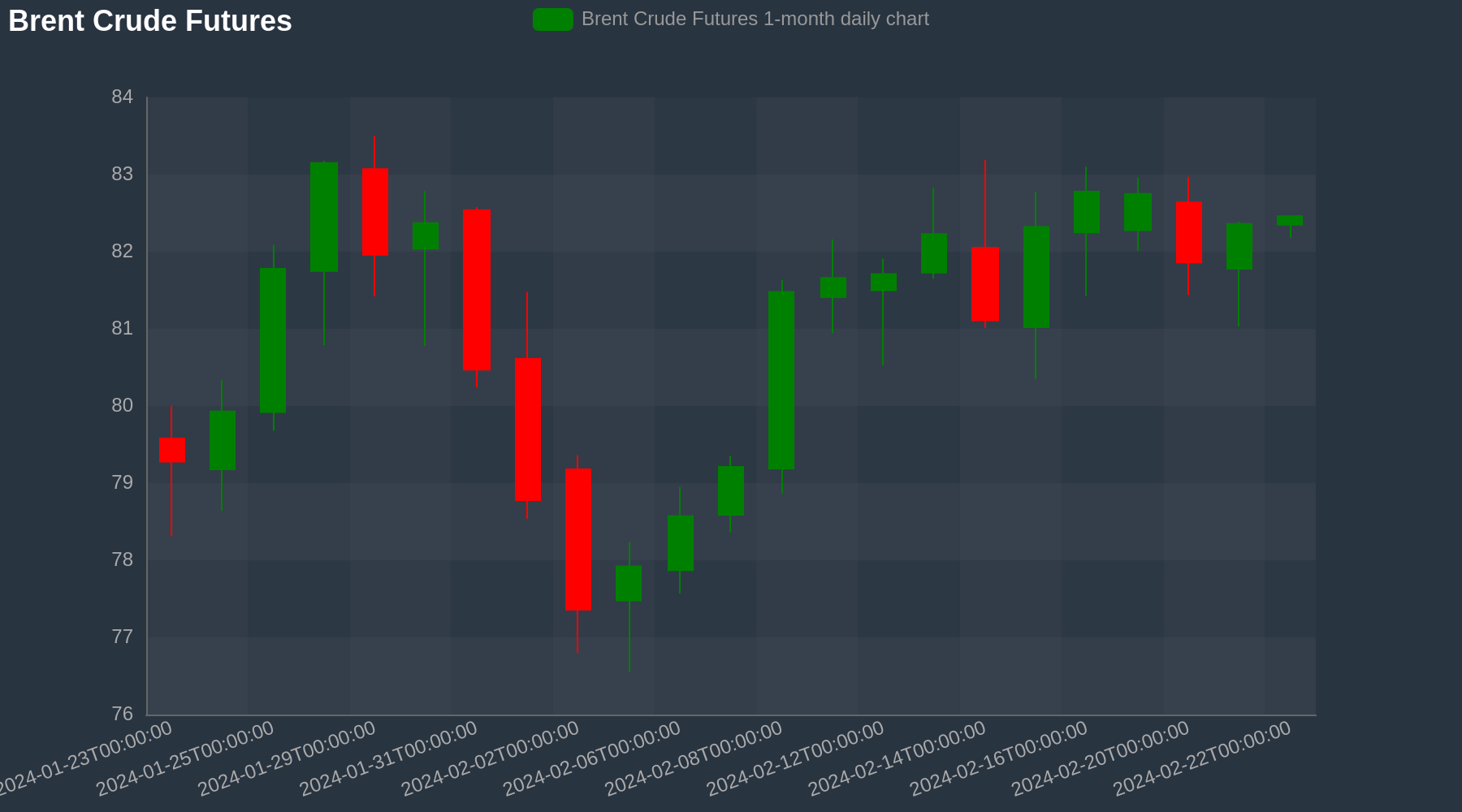

Energy: Oil Extends Rally

Black gold shines! Brent Crude and WTI Crude futures extend their upward climb, rising around 0.1% each. Ongoing supply concerns and geopolitical tensions continue to provide support for oil prices.

- Brent Crude (UKOIL) continued its rally to pick up 0.11% to $82.452 a barrel.

- WTI Crude (OIL) also edged 0.11% to $78.024 a barrel.

- Yet, Natural Gas (NATGAS) declined 0.56% to $1.869/MMBtu.

Please note that live rates are taken at about 06:05 AM GMT - compared to yesterday’s close.

In Summary

Global markets present a mixed picture. Antipodean currencies and oil prices find support, while Asian equities look optimistic. European investors remain on the sidelines, awaiting further catalysts. Stay tuned for updates throughout the trading day as the story unfolds!