Morning Digest: Muted Start As Investors Ponder Next Move

London: 27 February 2024 (TraderMade): Global markets are experiencing a subdued start this morning as investors pause following recent gains and digest mixed economic signals. The forex markets see modest fluctuation, equity markets in Asia trended lower, and energy futures ticked slightly downwards.

Key Takeaways

- Yen (JPY) and Australian Dollar (AUD) gain while the New Zealand Dollar (NZD) and British Pound Sterling (GBP) lag.

- Today's market movements are relatively muted, with no significant surprises across G10 currencies or major equity indices.

- Markets are holding as investors await fresh economic data for directional cues.

- Upcoming inflation readings, particularly in the US, will be closely observed for their potential impact on central bank policies.

Forex Watch

Top Gainers

The Japanese Yen (JPY) and Australian Dollar (AUD) are today's top gainers in the G10 FX market.

The USDJPY pair declined 0.16% to 150.469.

AUDUSD gained 0.04% to 0.65424.

Top Losers

The New Zealand Dollar (NZD) and British Pound (GBP) lag.

NZDUSD decreased 0.18% to 0.61615.

GBPUSD slipped 0.05% to 1.26799.

The US Dollar maintains a relatively steady position as investors look toward upcoming inflation data for signals on the Federal Reserve's future monetary policy.

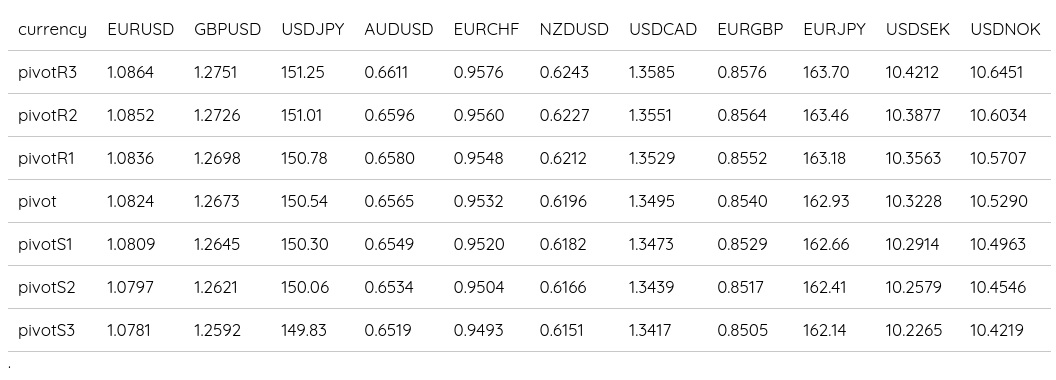

Forex Daily Pivot Points

Equities: Asian Markets Subdued, European Indices Mixed

Asia Declines

Asian equity markets experienced a weaker session, with the Nikkei 225 (Japan) and Hang Seng (Hong Kong) logging marginal declines.

The Nikkei 225 (JPN225) traded at 39238.0, down 0.05%. The Hang Seng (HKG33) was trading at 16619.0, down -0.28%.

Europe Mixed

European indices are currently showing a mixed picture, with the DAX 30 (Germany), CAC 40 (France), and FTSE 100 (UK) trading relatively flat.

- FTSE (UK100) was at 7698.5.

- CAC 40 (FRA40) was at 7927.5.

- DAX 30 (GER30) was at 17435.8.

US Opens Weaker

S&P 500 futures indicate a slightly weaker open for US markets later today.

Popular US Indices

- The Standard & Poor's Poor's 500 (SPX500) dipped 0.03% to 5066.65.

- Nasdaq (NAS100) slipped 0.05% to 17906.3.

- Dow Jones Industrial Average (USA30) slightly edged up to 39074.

Energy Sector: Oil Prices Cautious

WTI Crude and Brent Crude oil futures are trading slightly lower today, suggesting some caution in energy markets.

- Brent Crude (UKOIL) gained slightly by 0.06% to $81.763 a barrel.

- WTI Crude (OIL) followed suit by edging up 0.11% to $77.486 a barrel.

- Natural Gas gained 0.11% to $1.774/MMBtu.

Precious Metals

- Gold (XAUUSD) was up 0.12% to 2033.6201.

- Silver (XAGUSD) gained slightly by 0.06% to 22.5355.

- Platinum (XPTUSD) increased by 0.68% to 886.44995.

Summary

Global markets are displaying a sense of cautiousness today as trading remains range-bound within a narrow corridor. Investors are likely taking a breather after recent rallies. They are watching upcoming economic data for more apparent hints on the trajectory of interest rates and overall market sentiment.