Morning Digest: Mixed Signals Prevail in Global Markets

London: 28 February 2024 (TraderMade): Global markets are exhibiting mixed signals today, with the US dollar and Japanese yen appreciating while Asian equities experience declines. The energy sector, however, offers a brighter spot with oil futures trading firmly.

Key Takeaways

- The US dollar and Japanese yen are experiencing appreciation in the foreign exchange market.

- Asian equities face losses, while European markets display a mixed performance.

- Energy futures, in contrast, are holding firm, indicating potential inflationary pressures.

Forex Market

USD and JPY Gain Strength

The G10 foreign exchange (FX) market witnesses the US dollar (USD) and Japanese yen (JPY) emerging as the top gainers today. This trend signifies an increase in their value compared to other major currencies.

Commodity Currencies Suffer

Conversely, the New Zealand dollar (NZD) and Australian dollar (AUD) are facing downward pressure, depreciating by 0.98% and 0.46%, respectively, against the USD.

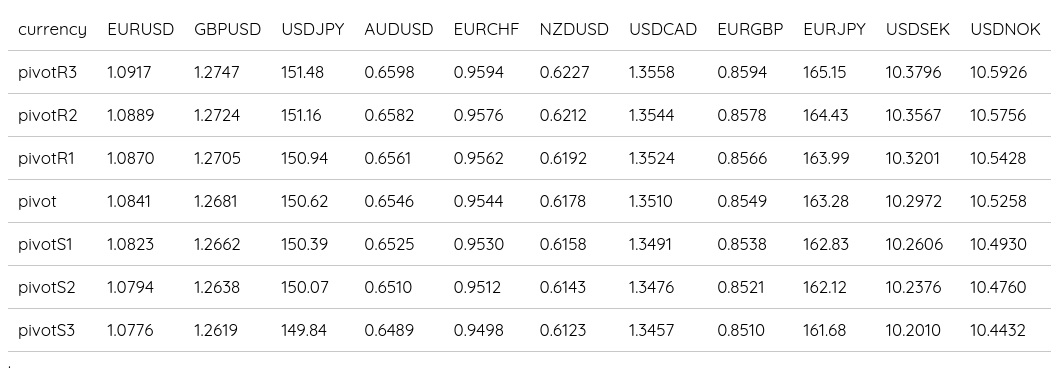

Forex Daily Pivot Points

Global Equities and Indices

Asian Equities Suffer Losses

Equity markets in Asia are experiencing a downturn today. The Nikkei 225 (JPN225), a primary stock market index in Japan, is trading at 39218.0 and down by 0.26%, while the Hang Seng (HKG33), a benchmark index representing the Hong Kong stock market, exchanging at 16690.0, has fallen by 0.94%.

European Equities Display Mixed Performance

European equity markets are currently presenting a mixed picture. The DAX 30 (GER30), a stock market index in Germany, is trading at 17597.3 and relatively flat, indicating minimal movement.

Similarly, the CAC 40 (FRA40), a benchmark index for the French stock market (Currently at 7952.5), and the FTSE 100, a stock market index for the United Kingdom (Currently at 7703.1), are also showing negligible changes.

Equity Futures

S&P 500 futures, which indicate the S&P 500 stock market index's future movement, currently point towards a slightly negative opening, with a potential decline of 0.01%.

Popular US Indices

- The Standard & Poor's 500 (SPX500) slightly dipped by 0.08% to 5078.85.

- Nasdaq (NAS100) slightly declined by 0.09% to 17963.8.

- Dow Jones Industrial Average (USA30) followed suit by dropping 0.08% to 38949.

Energy Markets

The energy sector is showing resilience. Both WTI Crude Oil and Brent Crude Oil futures, which represent contracts for the future delivery of crude oil, are holding ground with an increase of 0.24% and 0.09%, respectively.

- Brent Crude (UKOIL) slightly edged by 0.02% to $82.322 a barrel.

- WTI Crude (OIL) narrowly surged by 0.03% to $78.278 a barrel.

- Natural Gas (NATGAS) declined 0.13% to $1.855/MMBtu.

Precious Metals

- Gold (XAUUSD) was up 0.06% to 2031.635.

- Silver (XAGUSD) was up 0.05% to 22.4665.

- Platinum (XPTUSD) was down 0.44% to 888.80005.

Please note that the live rates are at about 06:05 AM GMT - Compared to yesterday's Close.

Summary

Global markets are sending conflicting signals today, signifying a period of uncertainty for investors. The strengthening USD and JPY, alongside weakness in Asian equities, suggest a possible shift towards safe-haven assets.

However, the stability observed in energy markets hints at potential inflationary concerns. As the day progresses, traders will closely monitor market developments to understand the future direction better.