Morning Digest: Mixed Mosaic with Some Gains

London: 29 April 2024 (TraderMade): Welcome to today's Morning Digest! The global financial markets present a mixed bag, with JPY & AUD gaining ground against the dollar, global indices positive, yet crude oil and gold declining. Let's peep into the details by going through various sectors:

Key Takeaways

- In G10 Forex, JPY and AUD shone (up 1.22% and 0.57%, respectively), and CAD and USD lagged.

- Asian markets were optimistic, as the Nikkei (JPN225) surged 0.41% and the Hang Seng (HKG33) surged 1.24%.

- European indices traded flat, while significant US indices surged: The S&P 500 and Dow Jones were up about 0.35%, while the tech-heavy Nasdaq 100 was up 0.53%.

- In the Energy space, Brent and WTI Crude declined by over 0.6%, while natural gas surged by 2.41%.

- Among precious metals, gold lost shine as it dipped 0.33% while silver slightly gained.

Forex

JPY and AUD are top gainers in G10 Forex Today

In the G10 FX Market, the Japanese Yen (JPY: Surged 1.22%) and the Australian Dollar (AUD: Soared 0.57%) are the top gainers versus the dollar today.

The Japanese Yen faces tremendous selling pressure, bringing the USDJPY pair near the 160 mark. Aussie dollar jumps as expectations rise for RBA rate hike after strong inflation data.

CAD and USD are top laggers

The Canadian Dollar (CAD) and the US Dollar (USD) are the top losers as they declined against the other major currencies.

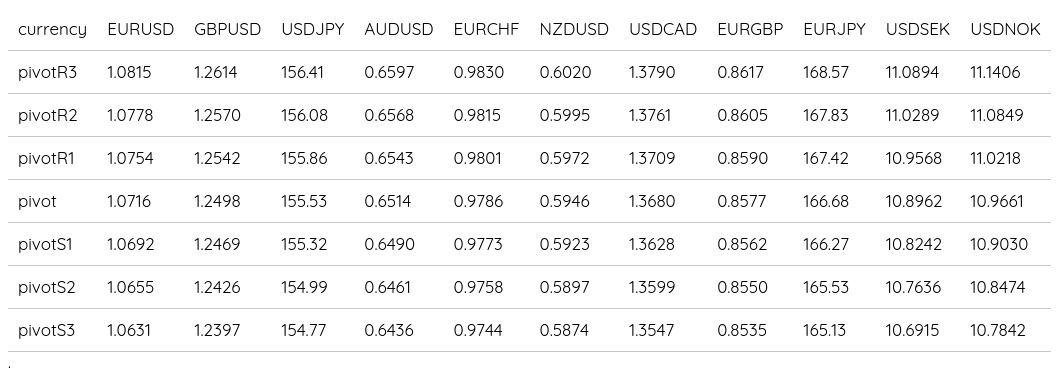

Forex Daily Pivot Points

Global Indices Optimistic

Asian Markets Strengthened

In Asian equities, markets were trading stronger today. The Hang Seng was trading at 17844.0, up 1.24%. The Nikkei 225 was trading at 38572.5, up 0.41%.

As Microsoft and Alphabet's great earnings last week indicate that investments in AI and cloud are paying off, Asian tech giant stocks moved in early.

European Indices Flat (Pre-Trading Hours)

- The UK's FTSE 100 (UK100) trades flat at 8170.9.

- France's CAC 40 (FRA40) trades flat at 8113.8.

- Germany's DAX 30 (GER30) trades flat at 18222.602.

US Equities Futures Narrowly Gained

Looking at Equity Futures so far, The SP500 Futures was trading at 5118.6504, up 0.09%.

Popular US Indices Surged

- Standard & Poor's 500 (SPX500) rose 0.37% to 5118.9004.

- Nasdaq (NAS100) surged 0.53% to 17806.148.

- Dow Jones Industrial Average (USA30) soared by 0.35% to 38399.

The rally in mega-cap tech stocks has been causing the surge in significant US indices.

Energy Markets

Crude Oil Futures Weakened

In the energy space, oil futures trade is weaker today. The WTI Crude Futures were trading at 82.925, down 0.02%, and the Brent Crude Futures were trading at 87.456, down 0.71%.

Crude Oil Spot Prices Declined

- Brent Crude (UKOIL) declined by 0.73% to $87.435 a barrel.

- WTI Crude (OIL) plummeted by 0.65% to $82.917 a barrel.

- Natural Gas (NATGAS) surged by 2.41% to $2.0585/MMBtu.

Easing up the Russian price cap proposal and the upcoming OPEC+ meeting may be behind the decline in crude oil prices.

Precious Metals Mixed

- Gold (XAUUSD) declined 0.33% to 2329.76.

- Silver (XAGUSD) slightly increased to 27.219.

Reduced geopolitical tensions may be behind the fall in precious metals prices.

To Summarize

Today's morning bell brought out optimistic signals for global indices, as Asia-Pacific and US indices performed well. Yet, there might be concerns for commodities as crude oil and gold prices dipped. Stay tuned with us as we provide the latest updates as the trading day unfolds.