Morning Digest: Global Markets Navigate Mixed Signals

London: 23 January 2024 (TraderMade): Market winds shift! Global bourses rise as optimism takes hold, but Asia paints a contrasting picture. Dive into our morning market deep dive for critical movements in forex, indices, and energy, and a peek into what lies ahead.

Key Points

- NZDUSD surges, USDJPY retreats.

- Risk-on sentiment pushes European and US indices higher.

- Nikkei dives on BOJ decision, Hang Seng jumps on rescue rumors.

- Oil prices continue to climb, and natural gas shows little movement.

Forex: Kiwi Takes Flight, Yen Feels the Chill

The New Zealand dollar soars against its American counterpart, breaking the 0.61 barrier on the back of improved risk sentiment. Meanwhile, the Japanese yen continues to weaken after the Bank of Japan's dovish decision to maintain its ultra-loose monetary policy, sending USDJPY down towards 148.

The NZDUSD pair surged by 0.42% to 0.61024. The USDJPY pair dipped 0.34% to 147.6065

Winds of Optimism Blow Across Europe and the US

European bourses continue their rally, with the French CAC 40 (FRA40) and German DAX (GER30) gaining over 0.3%, fueled by a resurgence of risk appetite.

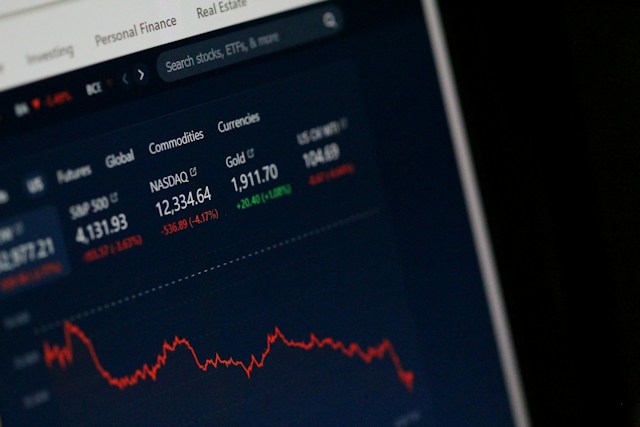

Across the pond, Wall Street starts cautiously, with the S&P 500 (SPX500) inching up marginally, Nasdaq (NAS100) posting a slightly more upbeat gain, and Dow Jones (USA30) barely making a dent. The muted US start could be a case of investors waiting for further cues from upcoming central bank meetings and economic data.

Asia: A Tale of Two Markets

The Nikkei 225 experienced a sharp correction, tumbling over 0.8% as the BOJ's decision weighs heavily on sentiment. Conversely, the Hong Kong Hang Seng defies the regional trend, surging by 1.49% on whispers of potential government intervention to stabilize the market. This paints a contrasting picture of Asia's response to global economic developments.

Energy Extends its Winning Streak

Brent (UKOIL) and WTI (OIL) crude continue their upward climb, fueled by robust global demand and ongoing supply concerns. Natural gas, however, remains almost flat, hovering around 2.129, waiting for the next catalyst to break its sideways movement.

Looking Ahead

The day promises to be eventful, with key central bank meetings in Europe and the US taking center stage. Market participants scrutinize new policy pronouncements and their potential impact on global markets. Economic data releases throughout the day and beyond could further shape sentiment and drive market movements.