Morning Digest: Currency Swings and Regional Divergence

London: 23 February 2024 (TraderMade): Today's global markets are a whirlwind of contrasting currents. While the Aussie and Kiwi soar in Forex, the Franc and Yen seek safe harbor. Asian bourses showcase cautious optimism, but Europe waits on the sidelines. The US market peeks out cautiously, and even energy prices dip. Read on to navigate the day's financial landscape!

Key Takeaways

- AUD and NZD shine in Forex, CHF and JPY falter.

- Asian markets display resilience, Nikkei and Hang Seng gain.

- European equities trade mixed, FTSE 100 waits for direction.

- US equity futures hint at a cautious start.

- Oil prices fall, and Brent Crude takes a bigger hit.

Forex

Aussie and Kiwi Soar

The foreign exchange market opened with a tale of two currencies today. The Australian Dollar (AUD) and New Zealand Dollar (NZD) took the lead, gaining 0.16% and 0.08% against the US Dollar, respectively. This strength can be attributed to improved risk appetite and expectations of a less hawkish US Federal Reserve.

Swiss Franc and Yen Sink

On the flip side, the Swiss Franc (CHF) and Japanese Yen (JPY) lost ground, down 0.06% and 0.03% against the USD, reflecting safe-haven flows amidst lingering geopolitical uncertainties.

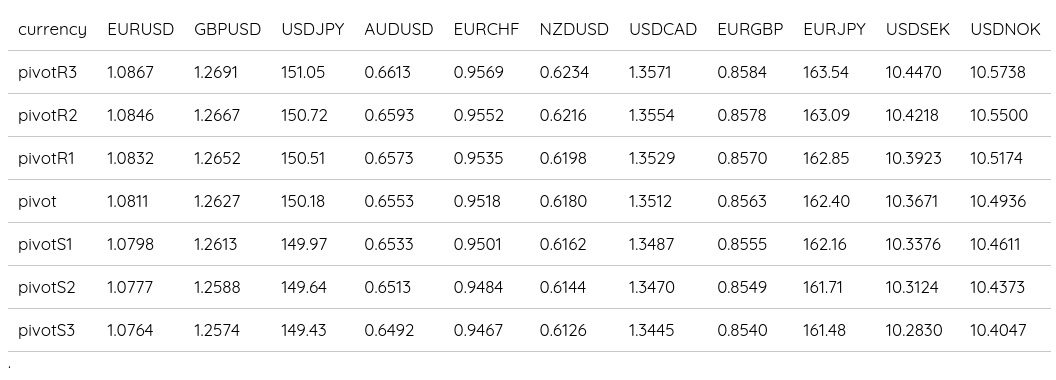

Forex Daily Pivot Points

Equities and Indices

Asian Equities: Firm Footing, Nikkei and Hang Seng Lead the Charge

Asian markets painted a picture of cautious optimism. The Nikkei 225 climbed 0.21% to 39,525.5, fueled by hopes of continued economic recovery and optimistic corporate earnings reports. The Hang Seng also impressed, rising 0.44% to 16,734.0, supported by recent policy easing measures in China.

European Equities: A Mixed Bag, FTSE 100 Waits on Sidelines

European markets presented a more mixed picture. The DAX 30 (GER30 - Currently at 17428.602)and CAC 40 (FRA40 - Currently at 7944.6)remained flat, awaiting the US and global economic data for more cues.

Meanwhile, the FTSE 100 (UK100 - Currently at 7706.8) remained on the sidelines, holding its ground as traders digested recent developments in the UK economy.

US Equity Futures: Cautious Start, S&P 500 Futures Inch Up

US equity futures hinted at a muted start for the Wall Street session. The S&P 500 Futures edged up 0.08% to 5,092.25, reflecting a wait-and-see approach before crucial economic data releases later in the week.

Popular US Indices

- The Standard & Poor’s 500 (SPX500) surged 0.197% to 5091.55.

- Nasdaq (NAS100) edged 0.15% to 18004.102.

- Dow Jones Industrial Average (USA30) gained 0.19% to 39129.

Energy Markets: Oil Futures Dip, Brent Crude Feels the Pinch More

The energy space saw oil prices retreat. WTI Crude Futures declined slightly by 0.08% to $78.033, while Brent Crude Futures fared worse, falling 0.18% to $82.49. Concerns about global demand and potential supply increases from Russia weighed on the market.

- Brent Crude (UKOIL) slipped 0.28% to $82.406 a barrel.

- WTI Crude (OIL) dipped 0.31% to $77.96699 a barrel.

- Natural Gas (NATGAS) decreased by 1.34% to $1.81/MMBtu.

Precious Metals Decline

- Gold (XAUUSD) slipped 0.08% to 2022.7351.

- Silver (XAGUSD) was down 0.55% to 22.6265.

- Platinum (XPTUSD) dropped 0.33% to 899.4.

Please note that the live rates are taken at about 05:54 AM GMT - Compared to yesterday’s Close.

Summary

Global markets opened with mixed signals today. Currency movements reflected contrasting risk sentiment, while regional equities showed diverse performances. The US market awaits further cues before taking a clear direction, and energy prices dipped on concerns about demand and supply. Investors will closely monitor upcoming economic data and geopolitical developments for further guidance.