Morning Digest: A Tale of Two Hemispheres

London: 21 February 2024 (TraderMade): As the sun rises on global markets, a mixed picture emerges. While Asian traders wake up to optimism, European investors remain more cautious. Let's delve deeper into the key regions and asset classes:

Key Takeaways

- Antipodean currencies benefit from improved risk sentiment.

- The Dollar encounters some headwinds as safe-haven demand wanes.

- Risk appetite seems higher in Asia, evidenced by the Hang Seng's surge.

- European markets take a more cautious approach, waiting for further catalysts.

- Oil maintains its momentum, supported by supply concerns.

G10 FX: Antipodeans Shine, Dollar Dims

Top Gainers

New Zealand Dollar (NZD) and Australian Dollar (AUD) lead the pack, both gaining over 0.3% against the US Dollar (USD). This rise suggests positive risk sentiment, particularly concerning these commodity-linked currencies.

Top Losers

The Yen (JPY) and USD fall out of favor, reflecting a potential shift in investors' preferences away from safe-haven assets.

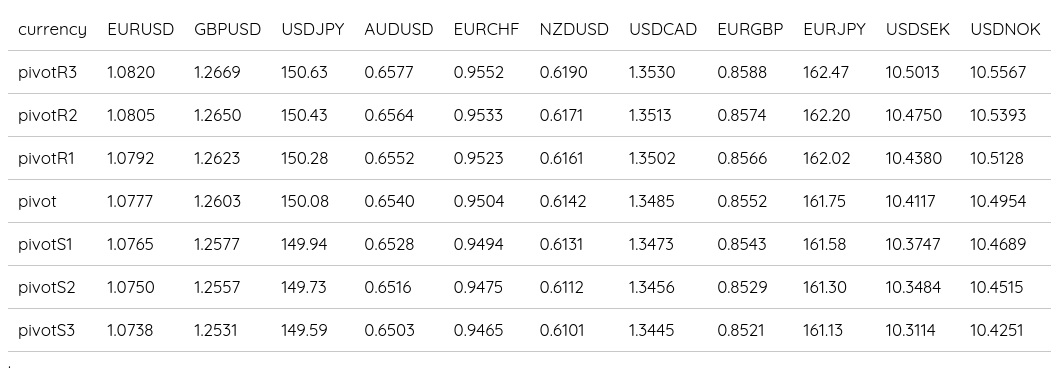

Daily Forex Pivot Points

Asian Equities: Hang Seng Soars, Nikkei Steady

Bullish Breakout

Hong Kong's Hang Seng Index jumps 3.11%, reaching 16,686.0. This significant gain indicates optimism in the Chinese market, potentially fueled by hopes of economic recovery or policy support.

Cautious Calm

Japan's Nikkei 225 shows minimal movement, edging up by 0.02% to 38,282.0. This cautiousness might reflect concerns about the ongoing global economic slowdown.

European Equities: Waiting for a Cue

Holding Pattern

The UK's FTSE 100 (UK100 - Currently at 7734.9), France's CAC 40 (FRA40 - Currently at 7798.6), and Germany's DAX 30 (GER30 - Currently at 17083.8) remain largely unchanged for now.

This lack of movement suggests European investors are waiting for further developments or key data releases before committing to specific directions.

Equity Futures: S&P 500 Futures Dip

Slight Downturn

US market futures open with a minor setback, with the S&P 500 futures currently down 0.05%. This downward trend could reflect some profit-taking after recent gains or anticipation of potentially mixed signals later in the session.

Popular US Indices

- The Standard & Poor's 500 (SPX500) was at 4975.2.

- Nasdaq (NAS100) was at 17522.7.

- Dow Jones Industrial Average (USA30) was at 38558.

Energy: Oil Extends Rally

Black Gold Shines

Both Brent Crude and WTI Crude futures continue their upward climb, rising around 0.2% each. This ongoing strength aligns with concerns about tight supply and ongoing geopolitical tensions.

- Brent Crude (UKOIL) was at $81.899 a barrel.

- WTI Crude (OIL) was at $77.131 a barrel.

- Natural Gas (NATGAS) was at $1.774/MMBtu.

Please note that the live rates are taken at about 06:09 AM GMT.

Summary

The global market picture remains mixed. The Dollar faces setbacks while Antipodean currencies and oil prices find support. While Asian investors embrace early optimism, European traders adopt a wait-and-see attitude. Market participants will closely monitor further developments throughout the trading day to assess the overall market direction. Stay tuned for updates!