Morning Digest: A Tale of Two Currencies and Mixed Equities

London: 16 February 2024 (TraderMade): The morning trading session paints a mixed picture across markets, with some currencies and indices gaining while others face headwinds. The markets offer opportunities and uncertainties for investors. Let's dive deeper into the key movers and shakers:

Key Takeaways

- USD and AUD gained fueled by positive factors, while JPY and NOK weakened due to risk aversion and economic concerns.

- Asian equities remain divided, with a robust gain in Hang Seng and a cautious outlook for Nikkei 225.

- European markets hold their ground, awaiting further direction.

- US stock futures point towards a potentially cautious start on Wall Street.

- Oil prices experienced a minor decline, indicating a shift in the market.

Currencies: Dollar & Aussie Climb, Yen & Krone Stumble

USD and AUD Lead the Charge

The US dollar (USD) and Australian dollar (AUD) are today's top gainers, fueled by economic optimism and positive data. The greenback finds support in strong inflation figures and a resilient economic outlook, while AUD benefits from rising commodity prices, particularly iron ore.

JPY and NOK Fall Short

The Japanese yen (JPY) and Norwegian krone (NOK) experienced losses against the USD (0.26% and 0.22% against the dollar, respectively). JPY's decline highlights risk aversion among investors, while concerns about the Norwegian economy contribute to NOK's weakness.

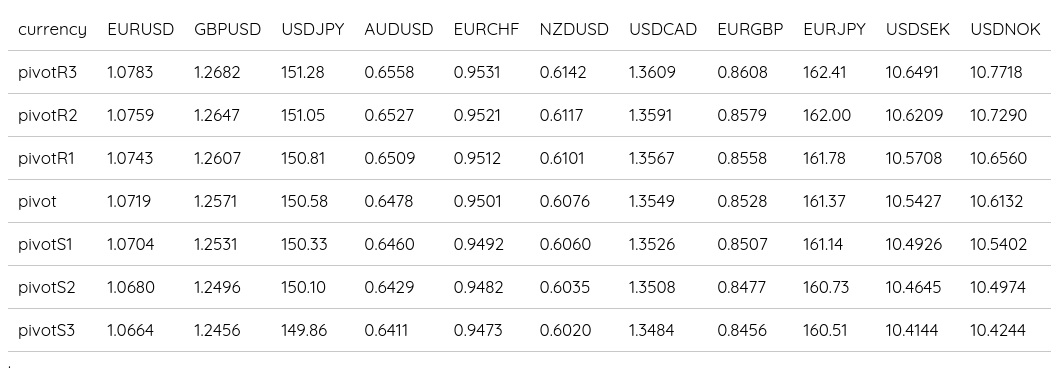

Forex Daily Pivot Points

Equity Markets: Asia Splits, Europe Waits

Hang Seng Shines, Nikkei Slips

Asian equities paint a diverse picture. Hong Kong's Hang Seng index climbs over 2% (currently 16384), likely boosted by positive developments in China's tech sector. However, Japan's Nikkei 225 dips slightly (currently 38624), indicating some caution among investors.

European Indices on Hold

The major European indices remain flat in early trading. Investors seem to be waiting for further cues before making their next move.

- The FTSE 100 (UK100) is currently 7638.7.

- CAC 40 (FRA40) is currently 7780.8.

- DAX 30 (GER30) is currently 17108.2.

US Futures Hint at Cautious Open

S&P 500 Futures Edge Lower

US stock market futures, represented by the S&P 500, experience a minor decline, suggesting a cautious start for Wall Street. Investors might be weighing global uncertainties and awaiting crucial economic data releases later today.

Status of Popular US Indices

- The Standard & Poor’s 500 (SPX500) is currently 5028.45.

- Nasdaq (NAS100) is currently 17878.55.

- The Dow Jones Industrial Average (USA30) is 38713.

Oil Prices See Subtle Downturn

Brent and WTI Dip

Both Brent and WTI crude oil futures witness a slight decline. This slight pullback could be due to potential supply increases or a temporary softening in demand.

- Brent Crude (UKOIL) dipped 0.58% to $82.302 a barrel.

- WTI Crude (OIL) dropped 0.62% to $77.6 a barrel.

- Natural Gas (NATGAS) increased by 1.6% to 1.6585.

Summary

The global market picture presents a nuanced landscape - with contrasting performances across currencies, equities, and commodities. While USD and AUD find strength, JPY and NOK face headwinds.

Asian equities display varying degrees of optimism, and European markets hold their breath. Investors remain cautious in the US, and oil prices see a slight correction. The rest of the trading day will reveal how these trends evolve and shape the overall market sentiment.