GBPUSD Stalls: BoE Hawk Talk vs. Global Jitters

London: 5 February 2024 (TraderMade): The British Pound (GBP) is treading water against the US Dollar (USD), unsure of its next move. Since the start of February, the GBPUSD pair has been stuck in a narrow range, reflecting a mixed bag of influences pulling it in different directions.

GBPUSD Stuck in Limbo: Key Takeaways

- BoE Turns Hawkish: Despite holding rates steady, Governor Bailey's comments suggest a prolonged period of tight policy, potentially weighing on the GBP.

- Fed Cut Hopes Fade: Strong US jobs data dampens expectations for an early rate cut, hurting risk-sensitive assets like the GBP.

- UK Recession Looms: Weak economic data and Q3 contraction raise concerns, potentially forcing the BoE to consider earlier rate cuts.

- Investor Focus: Upcoming PMI data could influence sentiment and the BoE's policy stance, impacting the GBPUSD trajectory.

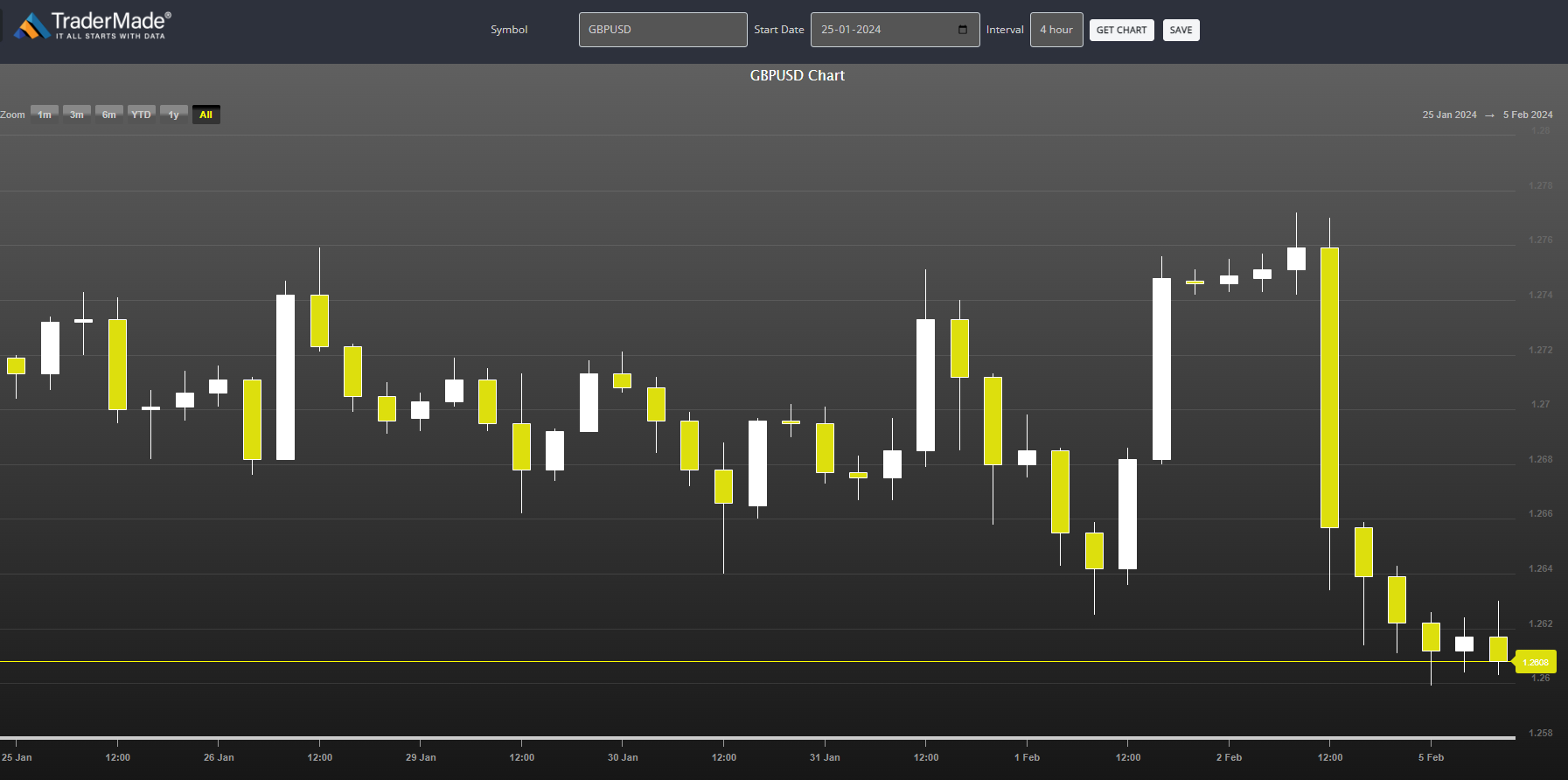

The above GBPUSD chart shows the pair’s trajectory over the past two weeks. GBPUSD pair fluctuated within the range of 1.264 to 1.276 till 1 February. It shows a maximum deviation of 0.95%.

As you can see, the GBPUSD pair peaked at 1.2772 on 2 February. Then, it dipped to 1.2599 earlier on 5 February. At about 09:56 AM GMT, the pair is at 1.26014.

Let's delve deeper into the factors shaping the pair's trajectory:

BoE Throws a Curveball

Rate Hold, But Words Bite: While holding interest rates steady at 5.25% as expected, Governor Bailey's subsequent remarks surprised markets. His emphasis on a prolonged period of restrictive monetary policy shifted the focus from the magnitude of potential future cuts to their duration, indicating a more cautious approach.

Hawkish Stance: Friend or Foe for GBP?

Headwinds for the Pound: The BoE's hawkish tilt might pressure the GBP, as investors might favor currencies backed by central banks with clear dovish intentions.

Technical Outlook: Foggy Horizon

- Stuck in Neutral: Short-term charts offer no clear guidance, with the pair hovering around its 50-day moving average.

- Breakout Watch: A decisive break above 1.2772 could signal a potential bullish move, while a decline below 1.2625 might indicate further weakness.

Countervailing Forces

However, concerns about a global economic slowdown and geopolitical tensions could limit the GBP's downside as investors seek safe havens.

Fed Cuts Fade

Investors' dreams of a March rate cut by the Fed evaporated after better US jobs data revealed resilient job creation and higher wages, suggesting persistent inflation pressures. This dashed hopes for an early policy shift, pushing risk-sensitive assets like the Pound lower.

UK Recession Looms

Meanwhile, the UK economy is teetering on the edge of a technical recession. A revised Q3 GDP estimate confirmed a 0.1% contraction -further weakness is expected in Q4. This bleak outlook and higher living costs due to interest rate hikes may squeeze businesses and dampen economic activity.

BoE in a Bind

This puts the Bank of England (BoE) in a tricky spot. While they seem more hawkish than the Fed, the deteriorating UK economy might force them to consider rate cuts sooner. Swati Dhingra, a lone dissenter in the last meeting, voted for a rate cut, and her voice may gain more support as economic realities bite.

Investors Eye PMI

All eyes are on the upcoming S&P Global Composite and Services PMI data. A positive reading could offer hope, but even steady data might not be enough to reverse the tide. Investors are anxious to see if the BoE will be swayed by the worsening economic climate and shift its stance towards easing.

Bottom Line

The GBPUSD pair's immediate path remains uncertain. The BoE's hawkish stance introduces a potential headwind for the GBP, but broader economic anxieties and upcoming data releases could offer countervailing forces. Investors should closely monitor further developments and crucial data releases before making decisive moves.

The Pound faces a perfect storm – dimming Fed cut hopes and a potential UK recession. While BoE's hawkishness offers some support, they might be forced to reconsider their stance if the economic situation worsens. Investors should brace for further volatility in the Pound as they navigate this uncertain landscape.

Remember: This analysis is based on limited information and should not be considered financial advice.