Forex Newsletter: Positive Start with AUD & NZD Surging

London: 12 September 2024 (TraderMade): Welcome to today’s FX Newsletter! The global financial markets indicate an optimistic start this morning, with Aussie & Kiwi leading the pack in Forex and positive signals across Asian and US indices, Energy and Metal Markets. Let’s take you through the sector-wise updates:

Key Takeaways

- Forex: AUD (Up 0.24%) & NZD (Up 0.24%) surged while JPY (Down 0.27%) & CHF (Down 0.12%) declined vs USD.

- Asia-Pacific Surged: Nikkei (JPN225) soared 0.41%, and Hang Seng (HKG33) also edged up 0.62%.

- European Indices Unchanged: FTSE (UK100), CAC (FRA40), and DAX (GER30) traded flat at writing time.

- US Markets Surged: S&P 500 (SPX500) soared 0.27%, Nasdaq (NAS100) edged up 0.4%, and Dow Jones (USA30) followed suit to soar 0.24%.

- Energy Markets Soared: Brent Crude (UKOIL) soared 0.76%, WTI Crude (OIL) surged 0.73%, and Natural Gas (NATGAS) also soared 0.62% today.

- Precious Metals Gained Shine: Gold (XAUUSD) soared 0.26%, and Silver (XAGUSD) surged 0.43%.

G10 Forex

AUD & NZD are Top Gainers

In the G10 FX Market, the Australian Dollar (AUD: Surged 0.24%) and New Zealand Dollar (NZD: Soared 0.24%) are the top gainers today versus the dollar (USD).

JPY & CHF are Top Laggers

The Japanese Yen (JPY: Dipped 0.27%) and Swiss francs (CHF: Slipped 0.12%) are the top losers versus the dollar (USD).

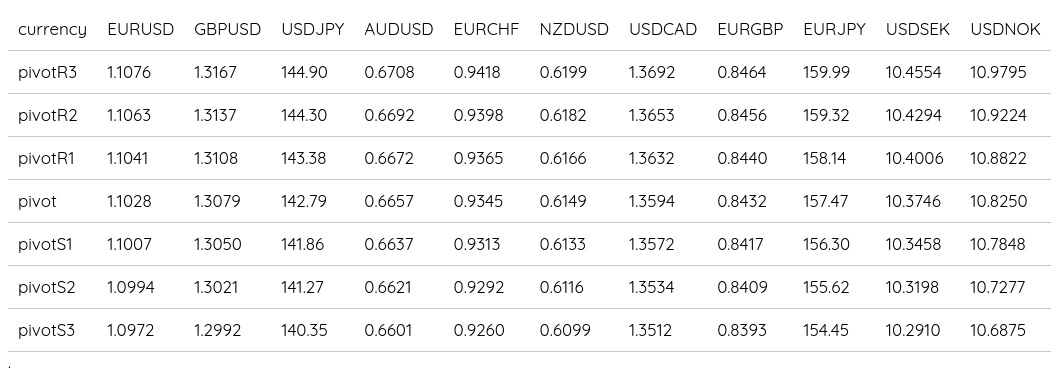

Forex Daily Pivot Points

Global Indices Mostly Positive

Asian Markets Strengthened

In Asian equities, markets were trading stronger today. The Nikkei (JPN225) was trading at 36799.5, up 0.41%. The Hang Seng (HKG33) was trading at 17313.5, up 0.62%.

Slowing wholesale inflation in Japan, BoJ’s indication of not raising interest rates amid market instability, and tech stocks’ boost in Wall Street are behind the surge in Asian indices today.

European Indices Flat

- The UK’s FTSE 100 (UK100) traded flat at 8265.4.

- France’s CAC 40 (FRA40) traded flat at 7466.1.

- Germany’s DAX 30 (GER30) traded flat at 18494.

US Equities Futures Edged Up

Looking at Equity Futures so far, the SP500 Futures was trading at 5566.8501, up 0.24%.

Popular US Indices Optimistic

Early sell-off due to an inflation report leading to a boom in tech stocks caused a surge in the US indices today:

- Standard & Poor’s 500 (SPX500) soared 0.27% to 5568.75.

- Nasdaq (NAS100) surged by about 0.4% to 19306.1.

- Dow Jones Industrial Average (USA30) edged up 0.24% to 40941.

Energy Markets Up

Crude Oil Futures Soared

In the Energy space, Oil futures were trading stronger today. The WTI Crude Futures was trading at 67.085, up 0.63%. The Brent Crude Futures was trading at 70.81, up 0.55%.

Spot Prices Heated Up

Increasing global demand for crude oil might have caused a considerable uptrend in oil prices:

- Brent Crude (UKOIL) surged 0.76% to $70.955 a barrel.

- WTI Crude (OIL) soared 0.73% to $67.22 a barrel.

- Natural Gas (NATGAS) also soared 0.62% to $2.5045/MMBtu.

Precious Metals Surged

Rising appeal of precious metals as safe-haven assets may be behind today’s rise in Gold & Silver prices:

- Gold (XAUUSD) edged up 0.26% to 2518.04.

- Silver (XAGUSD) surged 0.43% to 28.806.

To Summarize

Today’s forex trading newsletter covers the status of various financial instruments across forex, stock indices, and commodities at the morning bell. The global financial markets indicate a positive start. Stay tuned for the latest financial news as the ECB interest rate decision later today may change the market dynamics.

Live Rates at about 05:34 AM GMT are compared to the Last Close Values to calculate the Percentage Differences. Image Courtesy: Joshua Mayo on Unsplash