Forex Newsletter: Optimistic Beginning with NZD & NOK Shining

London: 29 August 2024 (TraderMade): Welcome to today’s FX Newsletter! The global financial markets indicate an optimistic start, with Kiwi & Norwegian Krone leading the pack in Forex and positive signs across Asian, European, and US stocks, Energy, and Metals markets. Let’s take you through the sector-wise updates:

Key Takeaways

- Forex: The New Zealand Dollar (NZD) and the Norwegian Krone (NOK) have shown strong performance, gaining 0.77% and 0.28%, respectively, against the USD, while the USD and JPY declined.

- Asia-Pacific Surged: Nikkei (JPN225) surged 0.69%, and Hang Seng (HKG33) soared 0.11% today.

- European Indices Unchanged: FTSE (UK100), CAC (FRA40), and DAX (GER30) traded flat at writing time.

- US Markets Slightly Edged Up: S&P 500 (SPX500), Nasdaq (NAS100), and Dow Jones (USA30) narrowly edged up.

- Energy Markets Heated Up: Brent Crude (UKOIL) and WTI Crude (OIL) have seen significant gains, soaring 0.42%, and Natural Gas (NATGAS) making even more substantial gains of 2.62% today.

- Precious Metals Gained: Gold (XAUUSD) has surged by 0.53%, and Silver (XAGUSD) has also seen a significant gain of 1.23% today.

G10 Forex

NZD & NOK are Top Gainers

In the G10 FX Market, the New Zealand Dollar (NZD: Surged 0.77%) and Norwegian Krone (NOK: Soared 0.28%) are the top gainers today versus the dollar (USD). This indicates a positive sentiment towards these currencies, possibly due to strong economic data or market expectations.

USD & JPY are Top Laggers

The US Dollar (USD) and Japanese Yen (JPY) are the top losers as they declined against the other major currencies today.

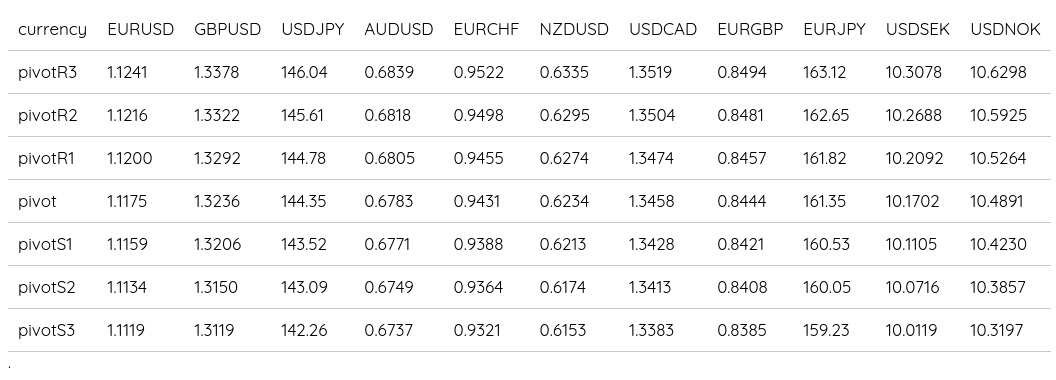

Forex Daily Pivot Points

Global Indices Mostly Optimistic

Asian Markets Gained

In Asian equities, markets were trading stronger today. The Nikkei (JPN225) was trading at 38318.5, up 0.69%. The Hang Seng (HKG33) was trading at 17676.0, up 0.11%.

European Indices Flat

- The UK’s FTSE 100 (UK100) traded flat at 8353.

- France’s CAC 40 (FRA40) traded flat at 7581.3.

- Germany’s DAX 30 (GER30) traded flat at 18788.5.

US Equities Futures Soared

Looking at Equity Futures so far, The SP500 Futures was trading at 5579.5, up 0.37%. This uptrend suggests a positive market sentiment and could indicate a potential uptrend in the US stock market when it opens for trading.

Popular US Indices Slightly Up

- Standard & Poor’s 500 (SPX500) slightly increased to 5582.45.

- Nasdaq (NAS100) narrowly edged up to 19255.95.

- Dow Jones Industrial Average (USA30) edged up 0.09% to 41232.

Energy Markets

Crude Oil Futures Strengthened

In the Energy space, Oil futures were trading stronger today. The Brent Crude Futures was trading at 77.66, up 0.36%. The WTI Crude Futures was trading at 74.2, up 0.3%.

Spot Prices Surged

- Brent Crude (UKOIL) soared 0.42% to $77.71001 a barrel.

- WTI Crude (OIL) surged 0.42% to $74.25 a barrel.

- Natural Gas (NATGAS) gained 2.62% to $2.2465 /MMBtu.

Precious Metals Shone

- Gold (XAUUSD) surged 0.53% to 2517.97.

- Silver (XAGUSD) gained significantly by 1.23% to 29.488.

To Summarize

Today’s forex trading newsletter covers the status of various financial instruments across forex, stock indices, and commodities at the morning bell. The global financial markets started positively this morning. Stay tuned as significant economic releases, like Germany’s inflation rate and the US Quarterly GDP Growth Rate Estimate, may change the market dynamics.

Live Rates at about 05:41 AM GMT are compared to the Last Close Values to calculate the Percentage Differences. Image Courtesy: rawpixel.com on Freepik