Crypto Market Snapshot: Weekly Highlights

London: 11 January 2024 (TraderMade): Welcome to this week's edition of Crypto Recap! As the New Year kicks off, we're seeing a predictable dip in the market after the holiday fervor. But fear not, as prices are already showing signs of bouncing back.

Key Takeaway As 2024 begins, the crypto market sees a post-holiday dip but hints at recovery. Key highlights include U.S. exchanges nearing Bitcoin ETF approvals, Ethereum's Vitalik Buterin revealing 2024 plans, and Binance facing a $2.7 billion CFTC settlement. Bitcoin's price surged early in the year but has since shown volatility. Regulatory shifts globally, from South Korea to India, indicate the evolving landscape.

Let's dive into the highlights.

- U.S. exchanges finalize Bitcoin ETF applications; BlackRock expects approval soon.

- By 2024, crypto users may surpass $1 billion, as per Bitfinex.

- Bitcoin celebrates its 15th anniversary with over 90,000 wallets holding $1 million or more—a 300% rise since 2023.

- Binance faces a $2.7 billion settlement with CFTC.

- Crypto investment products attracted $2.2 billion in 2023; Zerocap offers Bitcoin Discounts for wholesale investors.

- China's central bank pushes for global crypto regulation.

- Ripple, Coinbase, and a16z fund a pro-crypto PAC for U.S. elections.

- Ethereum's Vitalik Buterin unveils 2024 strategy.

- Sotheby's reports $35 billion in 2023 digital art sales.

- Web3 scams caused $1.8 billion in losses in 2023, a 52% drop from 2022.

- FOMC indicates potential rate cuts; the U.S. added 216,000 jobs in December.

- The U.K. economy shrank by 0.1% in Q3 2023; the Bank of Japan maintains an accommodative policy.

Bitcoin's Rollercoaster: A Snapshot of Price Volatility in Early 2024

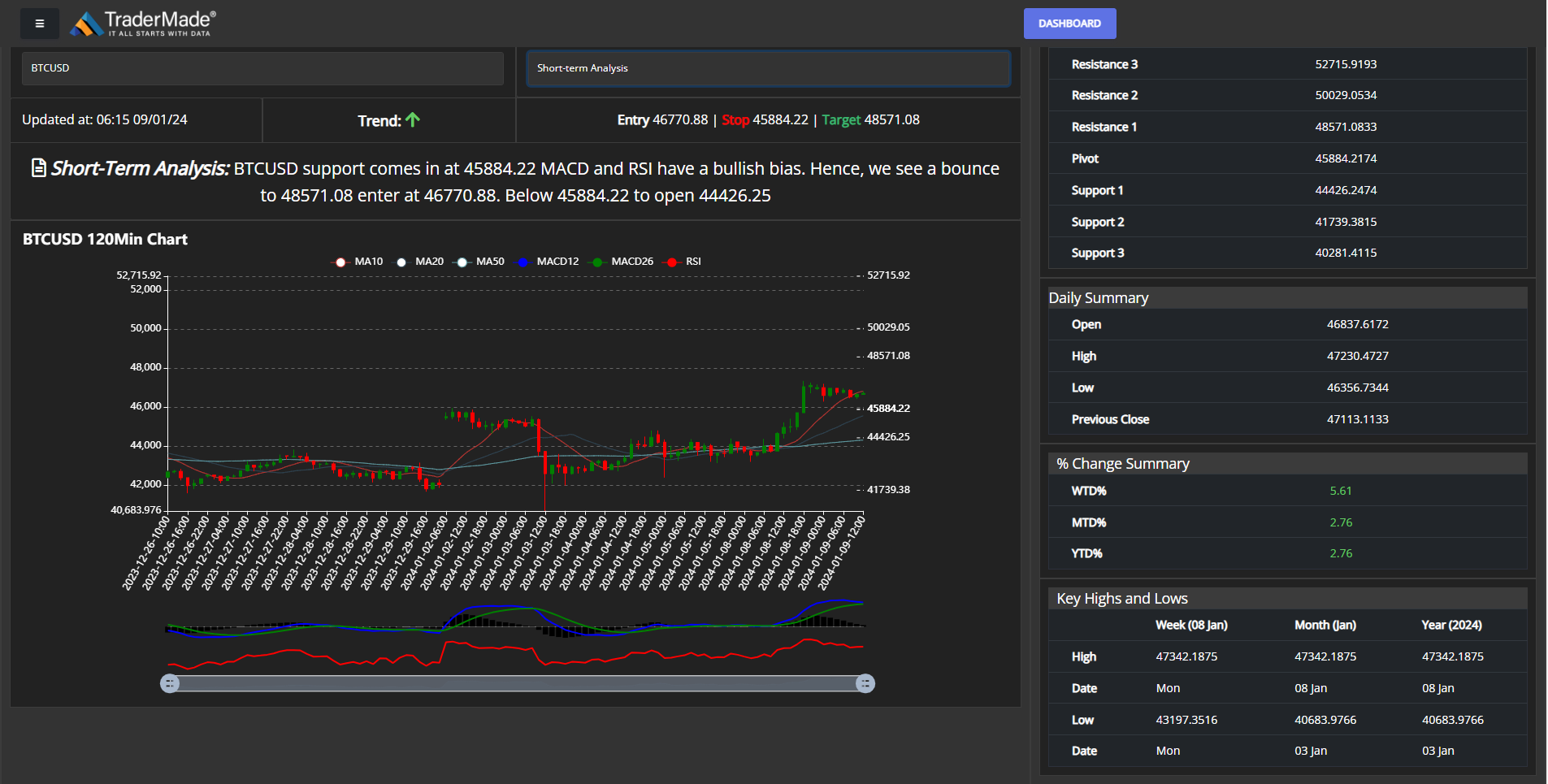

In a whirlwind start to the new year, Bitcoin (BTCUSD) showcased some remarkable price action that caught the attention of both traders and enthusiasts alike. As we bid farewell to 2023, BTCUSD closed on Friday, December 29th, at $42,031.4375. Fast forward to the dawn of 2024, and the digital gold didn't hesitate to clarify its intentions.

Opening on Tuesday, January 2nd, at an impressive $45,441.6328, Bitcoin seemed poised for another exhilarating ride. The momentum was palpable, with Monday, January 8th, witnessing a trading range oscillating between a low of $44,825.9766 and a high soaring to $47,324.1875.

However, keen observers would note that, despite these peaks, BTCUSD has begun its descent, gradually declining from those lofty levels. Check out the accompanying chart for a visual representation of this rollercoaster ride, capturing Bitcoin's fluctuating journey amidst the evolving market dynamics.

ETFs: A Focal Point

ETFs dominate discussions. These instruments enable investors to access crypto without owning assets directly. Since 2016, entities like BlackRock, Fidelity, and Grayscale have pursued ETF applications.

Notably, Grayscale's legal victory in 2023 has shifted attention. A pivotal SEC decision on Spot Bitcoin ETF is awaited, involving giants like JPMorgan and Coinbase. Expectations lean towards approval.

Regulatory Updates Worldwide

- South Korea contemplates banning credit card crypto purchases.

- Terraform Labs faces SEC scrutiny over Terra and Luna classifications.

- CatalX halts trading due to a potential security breach.

- OKX delists several token pairs, including DASH and XMR.

- Hong Kong proposes stricter oversight for stablecoin issuers.

- India intensifies crypto regulations, targeting significant exchanges like Binance.

Market Dynamics

The week anticipates an 83% likelihood of a Bitcoin ETF approval. Despite market optimism, Bitcoin's volatility remains evident. The competition among ETF issuers intensifies, with strategies ranging from aggressive marketing to community engagement.

Notably, VanEck plans to allocate BTC ETF proceeds to developers. While Bitcoin sees modest gains, Ethereum faces a 3.5% dip. Ethereum's future looks promising if approved, with potential price ranges between $1,800 and $3,000.

Conclusion

The forthcoming SEC decision promises significant shifts in the crypto sphere. Stay updated as the crypto world continues its dynamic journey!