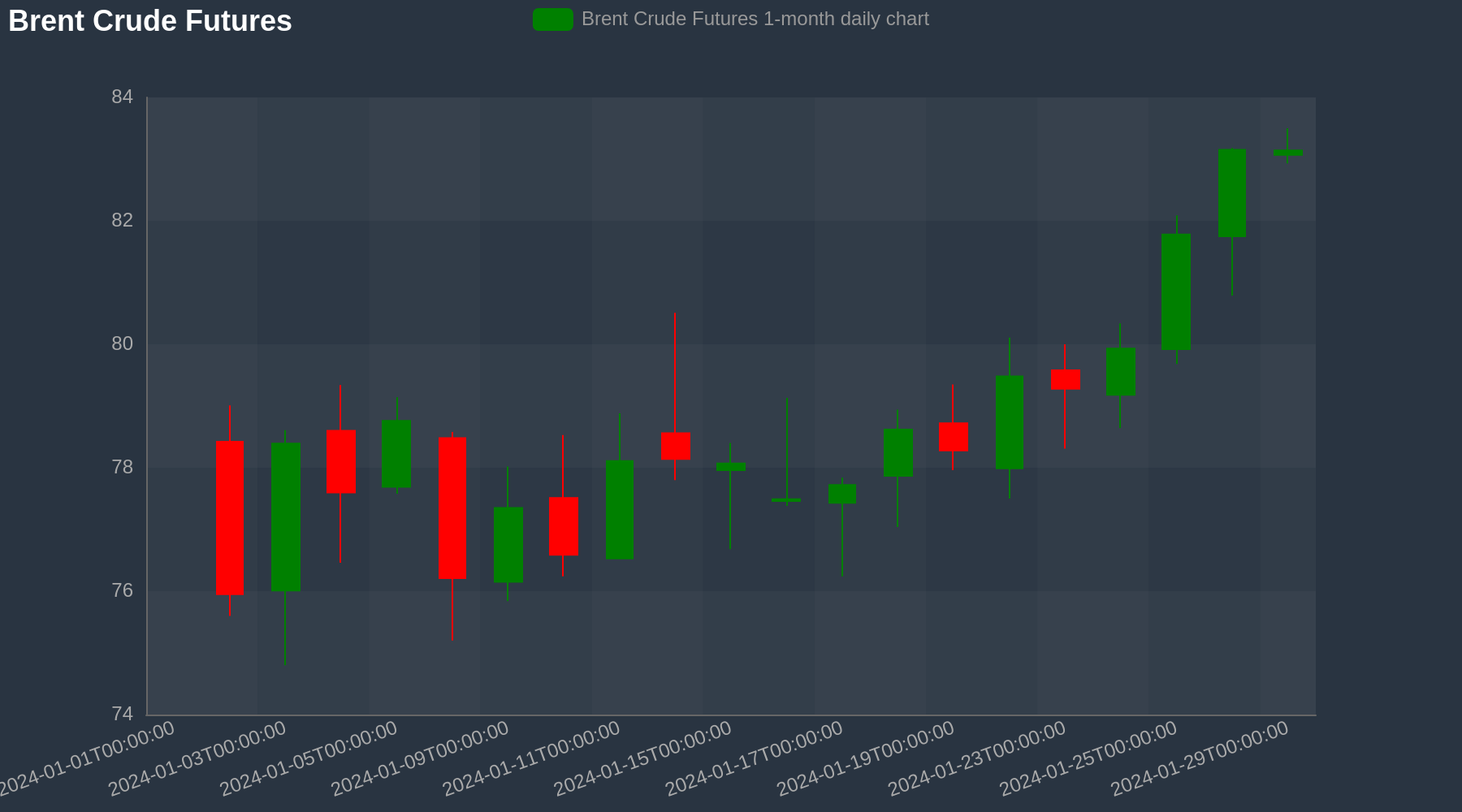

Crude Oil Reaches Two-Months High

London: 29 January 2024 (TraderMade): Oil prices have been on a roll for two weeks, reaching their highest levels since November thanks to a cocktail of positive and negative factors.

Brent Crude (UKOIL) surged by 4.48% to $83.039/barrel - compared to its 22 January Close.

WTI (OIL) edged by 4.72% to $78.128/barrel (At about 12:16 PM GMT).

Key Takeaways

- Positive factors like economic growth and supply concerns are pushing prices up.

- The forces like delayed rate cuts and increased drilling could act as brakes.

Economic Growth

On the positive side, the US and China, the world's top oil consumers, have experienced stronger-than-expected economic growth. This unexpected boost in economic activity has fueled optimism regarding future oil demand.

Furthermore, China's recent economic stimulus measures have contributed to this sentiment by suggesting an increase in oil consumption shortly.

Red Sea Supply Disruptions

However, there are also significant concerns weighing on the market. Firstly, there is growing anxiety about potential disruptions in the Middle East following recent events such as the targeting of an oil tanker in the Red Sea by Houthi rebels and a Ukrainian drone attack on a Russian oil refinery.

These incidents have heightened fears of supply disruptions in a region crucial to global oil production.

Tightening Inventories

Additionally, there is unease surrounding tightening inventories, particularly in the US. Crude oil stockpiles in the US have seen a larger-than-expected drawdown, particularly at the crucial Cushing delivery point. This has raised concerns about a potential "squeeze" on nearby futures prices, indicating a tightening supply situation.

Rate Hike Hangover

On the negative side, there are factors dampening market sentiment. Traders are adjusting their expectations for economic growth in response to the possibility of a delay in interest rate cuts by the US Federal Reserve until May. This "rate hike hangover" has led to a reassessment of economic outlooks, potentially dampening oil demand.

Surge in Production

Furthermore, there is a concern about a drilling uptick in the US, with energy firms adding more oil rigs. This suggests potential future increases in production, which could eventually offset price rallies by adding to global supply.

Winding Up

In summary, robust economic growth and stimulus measures lead to crude oil price hikes - the commodities market is also grappling with supply disruptions, tightening inventories, and concerns about future production increases. These opposing factors are contributing to volatility and uncertainty in the oil market.