The Japanese Yen (JPY) is Struggling to Find Strong Footing

London: 3 April 2024 (TraderMade): The Japanese Yen (JPY) is struggling to find strong footing, trading near its lowest levels in decades against the US Dollar (USD) on Wednesday. While the Bank of Japan's (BoJ) dovish stance weighs heavily on the JPY, intervention threats from Japanese authorities are limiting further declines.

Dovish BoJ, Strong Dollar Put Pressure on Yen

The BoJ's commitment to maintain loose monetary policy stands in stark contrast to the Federal Reserve's (Fed) hawkish signals. Recent US economic data, including a rebound in manufacturing and a tight labor market, has dampened expectations of Fed rate cuts this year. This widening gap in interest rates between Japan and the US strengthens the USD and weakens the JPY.

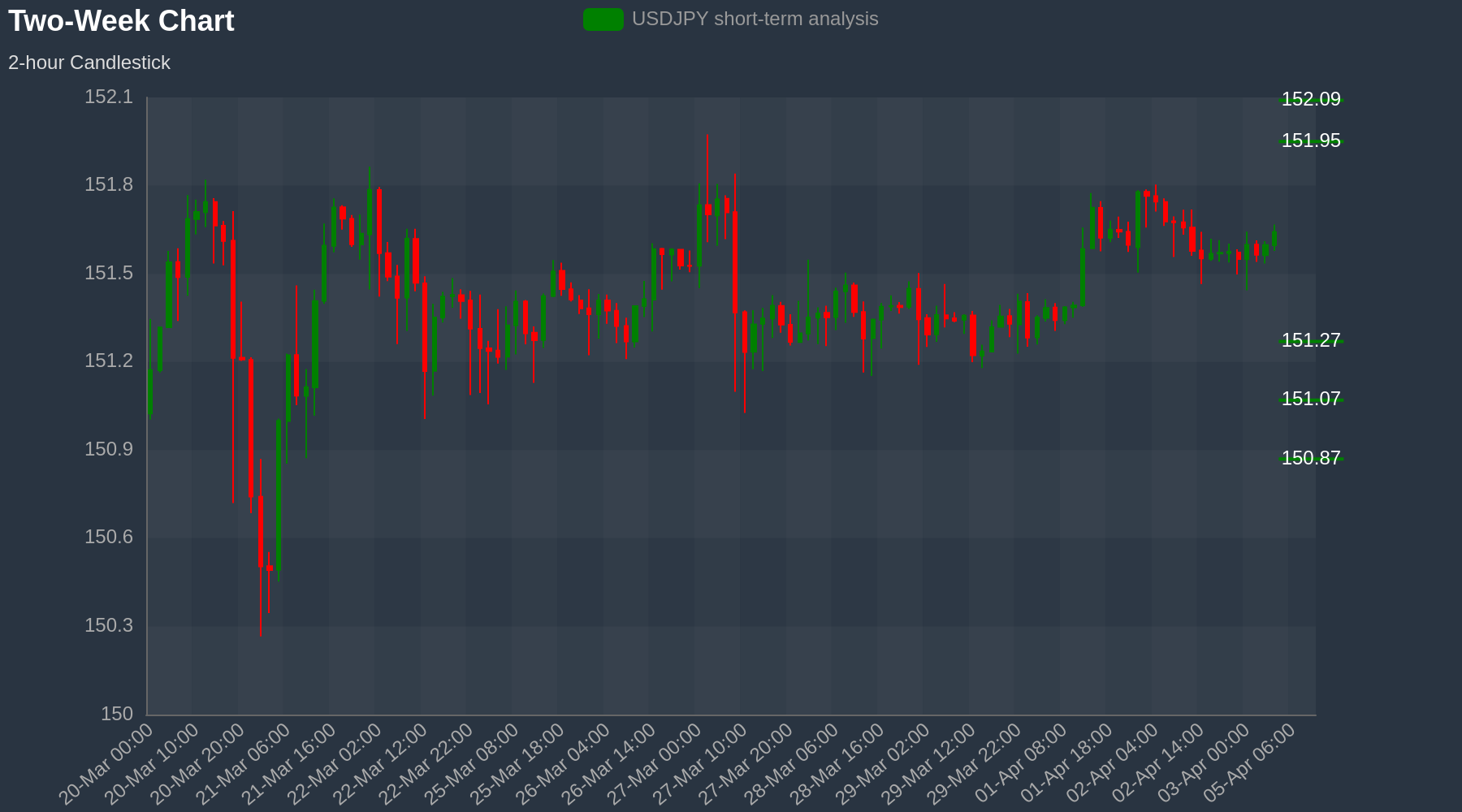

USDJPY Chart

Intervention Threat Looms, Capping Yen's Decline

Despite the JPY's weakness, comments from Japanese officials warning of potential intervention to defend the currency are offering some support. This threat is preventing the USD/JPY pair from surpassing the key psychological level of 152 JPY per USD.

Looking Ahead: US Data and Fed Policy in Focus

Market participants are now looking toward upcoming US data releases and further pronouncements from Fed officials for clues on the central bank's monetary policy trajectory. A stronger dollar outlook could continue to pressure the JPY in the near term.