Pound Finds Relief, But Clouds Linger

London: 21 December 2023 (TraderMade): The Pound Sterling rallied despite softer-than-expected UK inflation, but its future remains cloudy. Deeper cuts in November's CPI data fueled bets for earlier Bank of England (BoE) rate cuts, potentially weakening the currency in the long run.

Deeper Dive on Key Points and Challenges

Pound on the rise: Despite a surprise plunge in UK inflation, the Pound Sterling found temporary refuge around 1.26574 (At about 03:18 PM GMT), briefly brushing off worries about slower economic growth. This unexpected bounce reflects the fading pressure from rising prices, fueling speculation of earlier-than-expected Bank of England (BoE) rate cuts.

BoE on a seesaw: The BoE faces a tricky balancing act. While lower inflation eases the need for immediate tightening, policymakers remain cautious, emphasizing sustained price stability before considering rate cuts. This careful stance puts a damper on the Pound's rally.

Dollar downtrodden: The Greenback stumbled against the invigorated Pound, weighed down by weak US GDP data and mounting bets on Federal Reserve rate cuts. This helped propel the Pound higher, but its gains could be fleeting if US inflation data surprises on the upside.

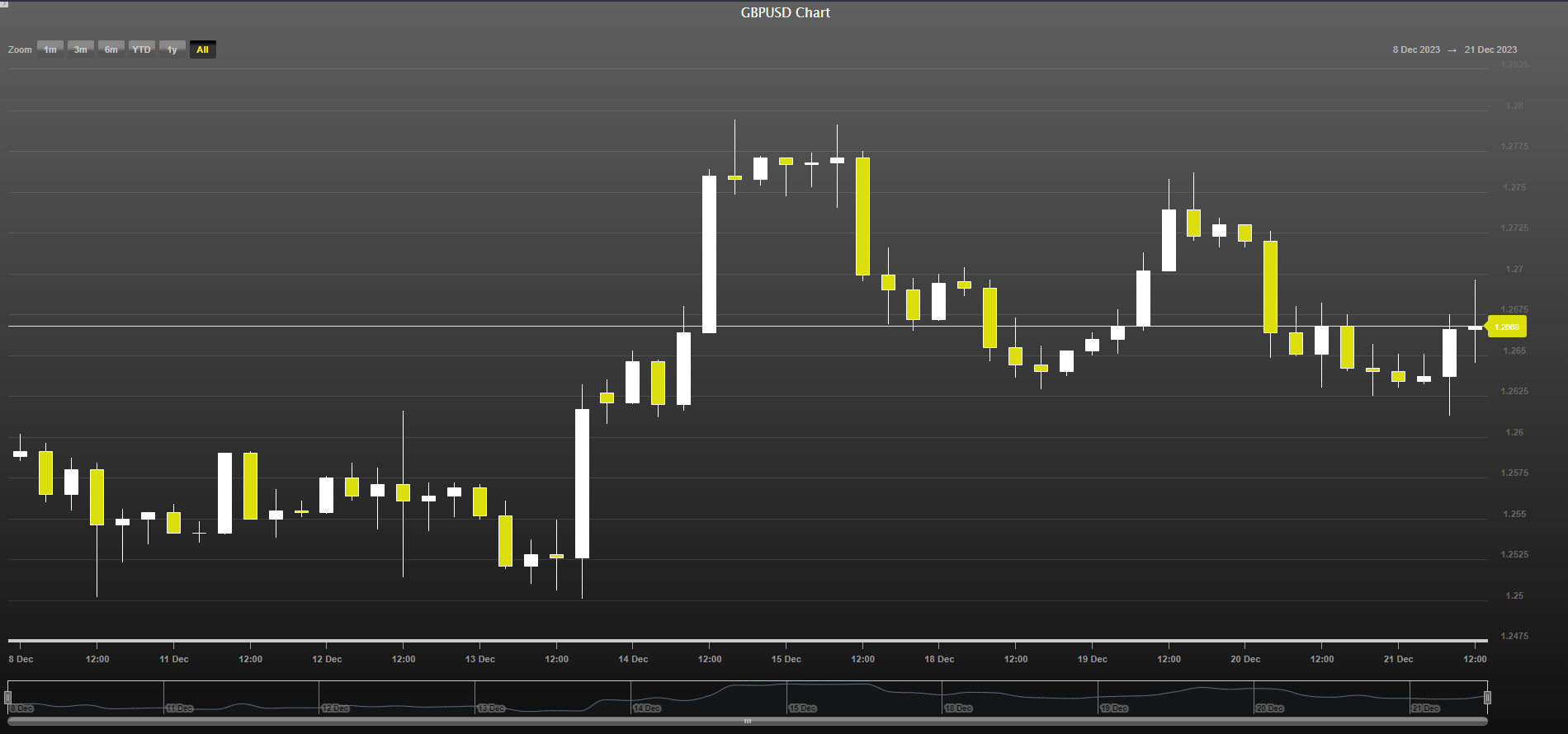

GBPUSD Chart by TraderMade: from 8 December 2023

GBPUSD Chart by TraderMade: from 8 December 2023

Retail rumble: Friday's UK retail sales figures will be the next battleground. Strong consumer spending could bolster the Pound's recent comeback, while a decline could renew concerns about economic momentum.

PCE plays pivot: The real game-changer arrives on Friday with the US Personal Consumption Expenditures (PCE) data. A soft inflation reading could further weaken the Dollar and solidify the BoE's dovish tilt, paving the way for a sustained Pound rally. However, a hotter-than-expected PCE would reignite Fed hawkishness, potentially sending the Pound back into retreat.

Challenges on the horizon: Even with a temporary boost, the Pound faces headwinds. Its competitive advantage, tied to a stricter monetary policy stance, has eroded as other central banks embrace easing. This could leave the Pound vulnerable to external shocks and hinder its long-term ascent.

In conclusion, the Pound's rebound brings hope, but its path remains uncertain. The BoE's cautious approach, US inflation data, and UK consumer spending will be crucial to determine whether the recent rally blossoms or fizzles out.

The Pound's recovery might be short-lived as market anticipation for BoE rate cuts and the upcoming US PCE data create a volatile environment. Friday's retail sales figures could offer some temporary relief, but the long-term trajectory of the GBP remains uncertain.