Dollar Retreats as Yen Finds Support on Intervention Threats

London: 26 March 2024 (TraderMade): The US dollar took a breather on Tuesday after a strong run, weighed down by profit-taking and a slightly firmer Japanese yen. Tokyo officials continued their verbal warnings to defend the Yen, pressuring the greenback.

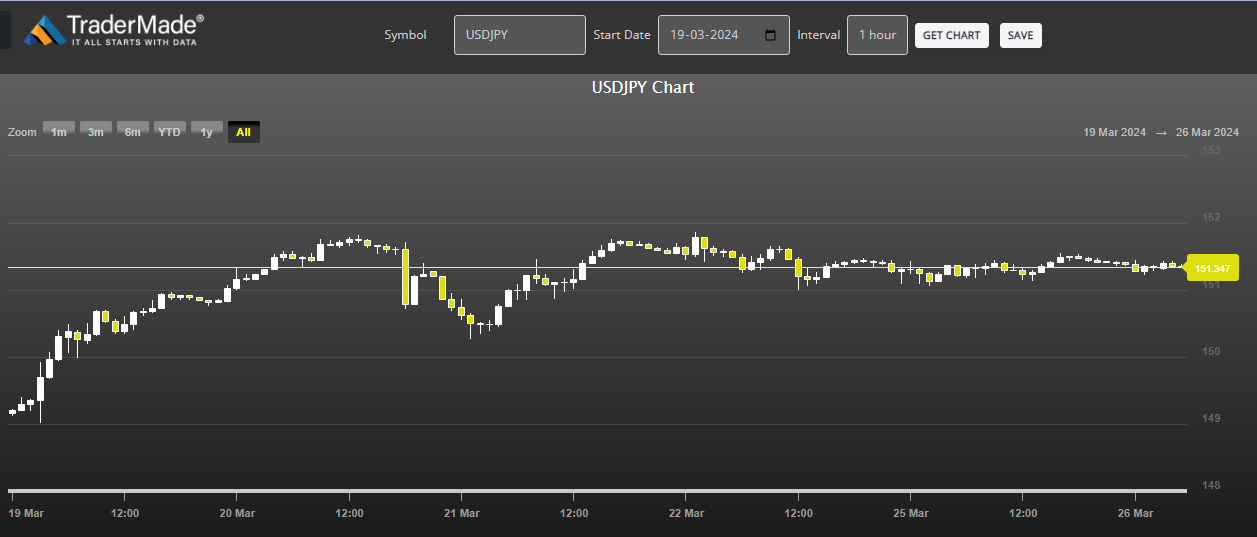

USDJPY trades flat from yesterday and is currently at 151.3835.

Japan Steps Up Defense of the Yen

Intervention threats and policy uncertainty cloud the outlook. The Yen received a boost after Japanese authorities reiterated their discomfort with the currency's recent slide.

Finance Minister Shunichi Suzuki echoed warnings from other officials, emphasizing the need for stable exchange rates based on fundamentals. This intervention threat, coupled with speculation of a slower pace of US interest rate hikes, helped the Yen hold its ground against the dollar.

Focus Shifts to US Inflation Data

Despite the Yen's uptick, the broader market focus remains on upcoming US economic data, particularly the Federal Reserve's preferred inflation gauge due later this week. A stronger-than-expected reading could reignite concerns about inflation and put the brakes on the dollar's recent decline.